Loan Management

Driving Efficiency in Financial Services.

Arkleap’s Loan Management Solution offers a robust and scalable platform for managing various financial services, including mortgages, leasing, factoring, and consumer loan portfolios. Designed to enhance operational efficiency, compliance, and customer experience, our solution empowers financial institutions to meet modern market demands.

Overview.

Comprehensive Loan Management for B2B and B2C Markets

Arkleap offers two distinct Loan Management Solutions tailored for diverse financial needs:

- Enterprise Financial Service (B2B): Designed for businesses, this solution helps manage capital, mitigate risk, and streamline financial operations.

- Consumer Financing Solution (B2C): Aimed at individuals and merchants, this product simplifies consumer credit management with flexible payment options and a seamless customer experience.

B2B Solution

Enterprise Financial Service.

Key Highlights

Advanced Factoring and Reverse Factoring Modules:

- Dynamic loan creation and lifecycle management.

- Flexible repayment schedules and automated revenue recognition.

Comprehensive Mortgage and Leasing Services:

- Streamlined approval workflows and secure data handling.

- Flexible fee and payment management for customized financial solutions.

Portfolio Management for Businesses:

- Robust transaction tracking and secure customer data management.

- Advanced reporting tools for effective decision-making.

B2C Solution

Consumer Financing Solution.

Key Highlights

Web Loan Management System:

- Supports loan origination, servicing, and customer applications.

- Integrated tools for credit evaluation and approval processes.

Consumer Mobile Web App:

- Enables users to register, apply for loans, and manage payments seamlessly.

- Real-time updates and notifications for a better user experience.

Merchant Web App:

- Simplifies merchant transactions with features for purchase management and monitoring.

- Offers flexible payment plans and compliance with regulatory standards.

Why Choose Arkleap Loan Management Solutions?

Tailored Solutions for Every Market:

B2B: Optimize business operations with robust financial tools. B2C: Enhance customer satisfaction with easy-to-use interfaces and flexible payment options.

Regulatory Compliance and Security

Features like OCR fraud checks, audit trail logs, and data encryption ensure compliance and safety.

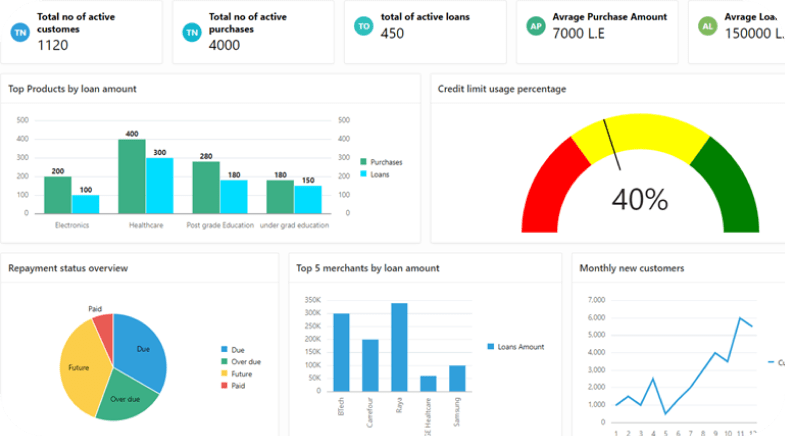

Real-Time Insights

Advanced dashboards and analytics offer real-time visibility into financial operations.

Seamless Integration

Fully compatible with Oracle Fusion/EBS and third-party systems.